https://www.techpowerup.com/232816/i...d-14-8-billion

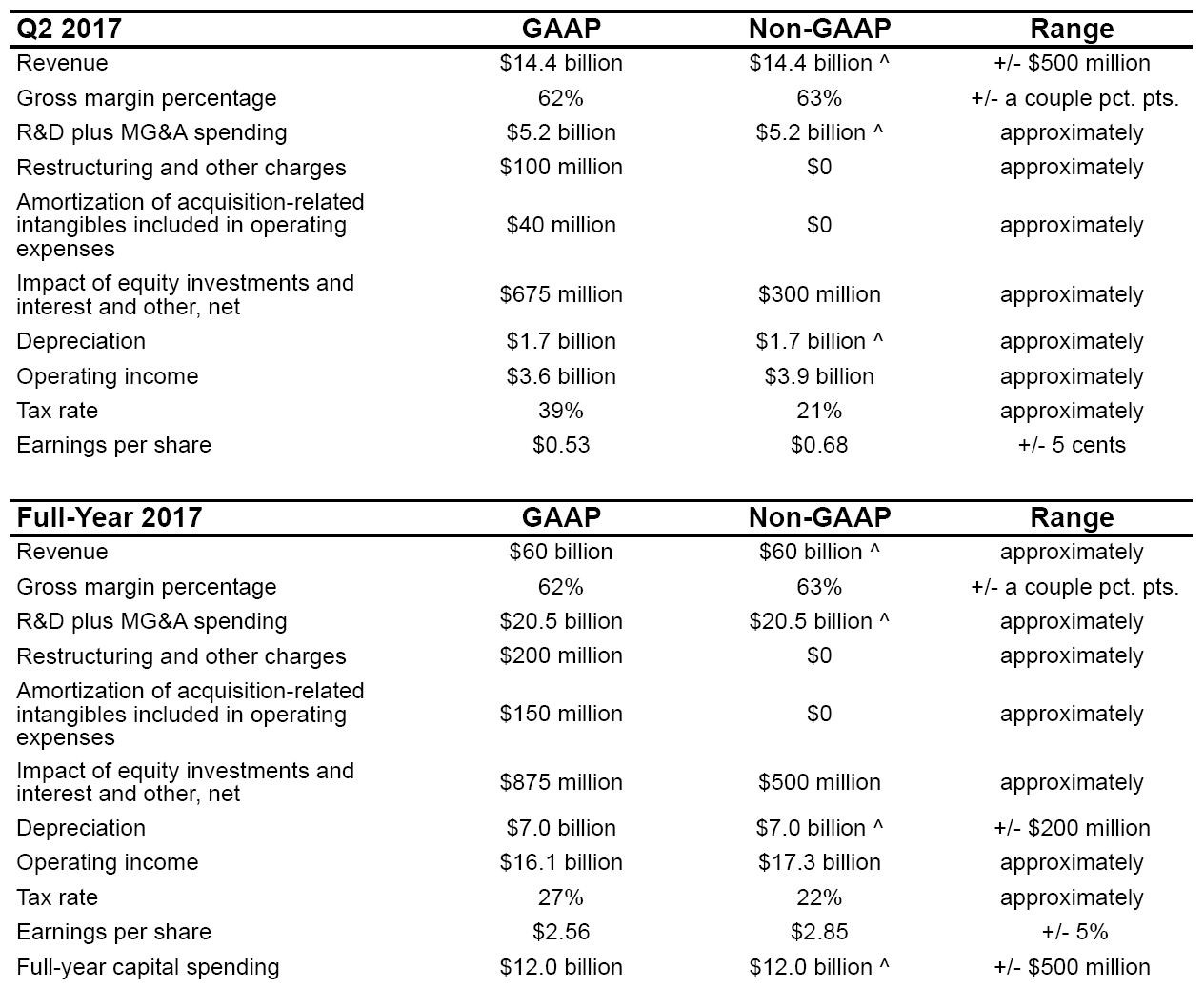

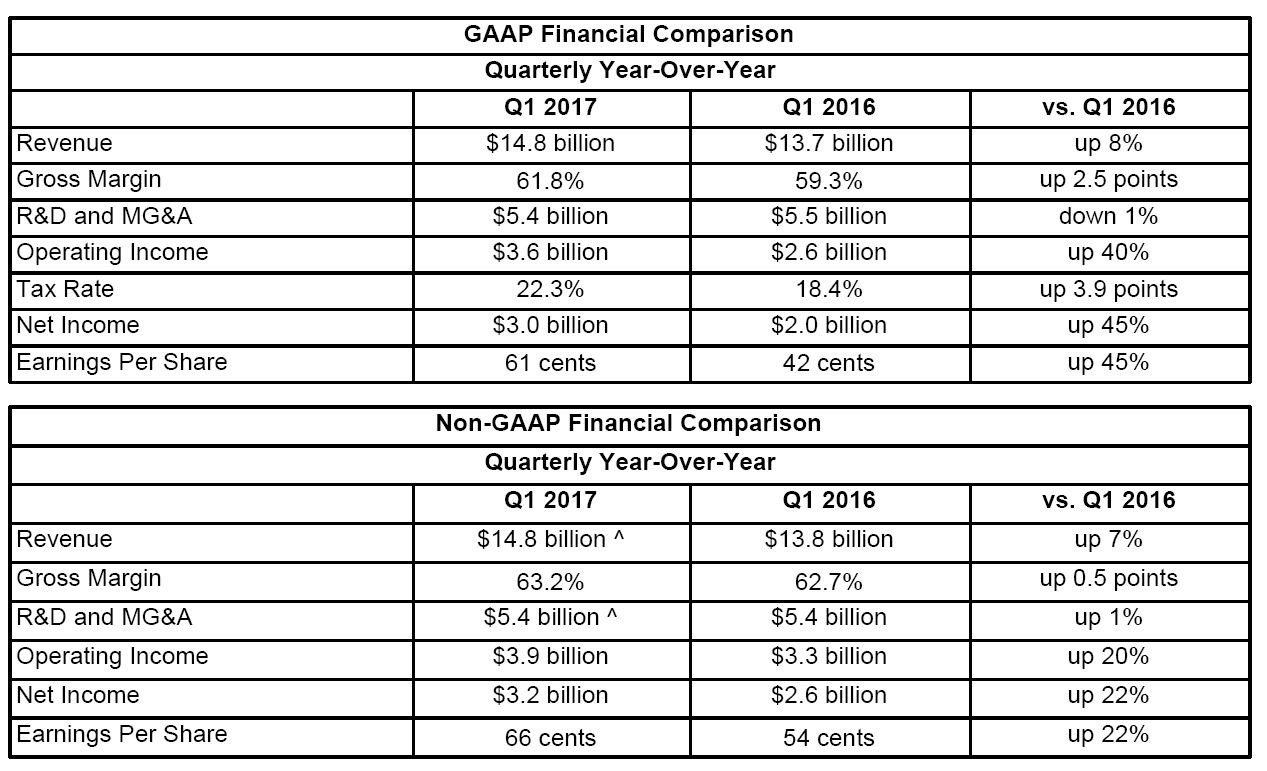

Intel Corporation today reported first-quarter revenue of $14.8 billion, up 8 percent year-over-year on a GAAP basis and 7 percent on a non-GAAP basis. Operating income was $3.6 billion, up 40 percent year-over-year, and non-GAAP operating income was $3.9 billion, up 20 percent. EPS was 61 cents, up 45 percent year-over-year, and non-GAAP EPS was 66 cents, up 22 percent.

The company also generated approximately $3.9 billion in cash from operations, paid dividends of $1.2 billion, and used $1.2 billion to repurchase 35 million shares of stock. Intel's board of directors has approved a $10 billion increase to Intel's share buyback program, which brings the amount currently available for future buybacks to approximately $15 billion."The first quarter was another record quarter, coming off a record 2016. We continued to grow our company, shipped our disruptive new Optane memory technology, and positioned Intel to lead in new areas like artificial intelligence and autonomous driving," said Brian Krzanich, Intel CEO. "The ASP strength we saw across nearly every segment of the business demonstrates continued demand for high-performance computing, which will only increase with the explosion of data."

- Client Computing Group revenue of $8.0 billion, up 6 percent

- Data Center Group revenue of $4.2 billion, up 6 percent

- Internet of Things Group revenue of $721 million, up 11 percent

- Non-Volatile Memory Solutions Group revenue of $866 million, up 55 percent

- Intel Security Group revenue of $534 million, down 1 percent

- Programmable Solutions Group revenue of $425 million, up 18 percent

Reply With Quote

Reply With Quote

Bookmarks